Newsletter Subscribe

Enter your email address below and subscribe to our newsletter

Enter your email address below and subscribe to our newsletter

The Trump administration has recently proposed a new tax rule that would allow servers, bartenders, and other tipped employees to keep their tips instead of sharing them with their employers.

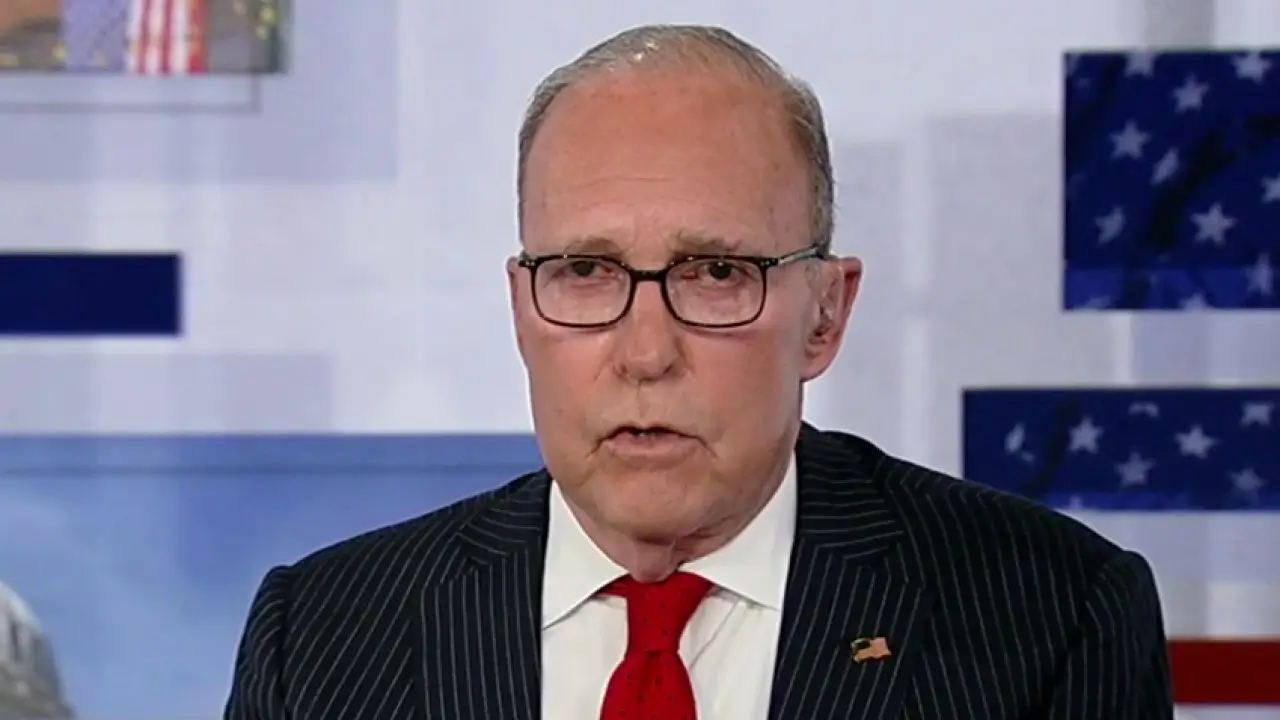

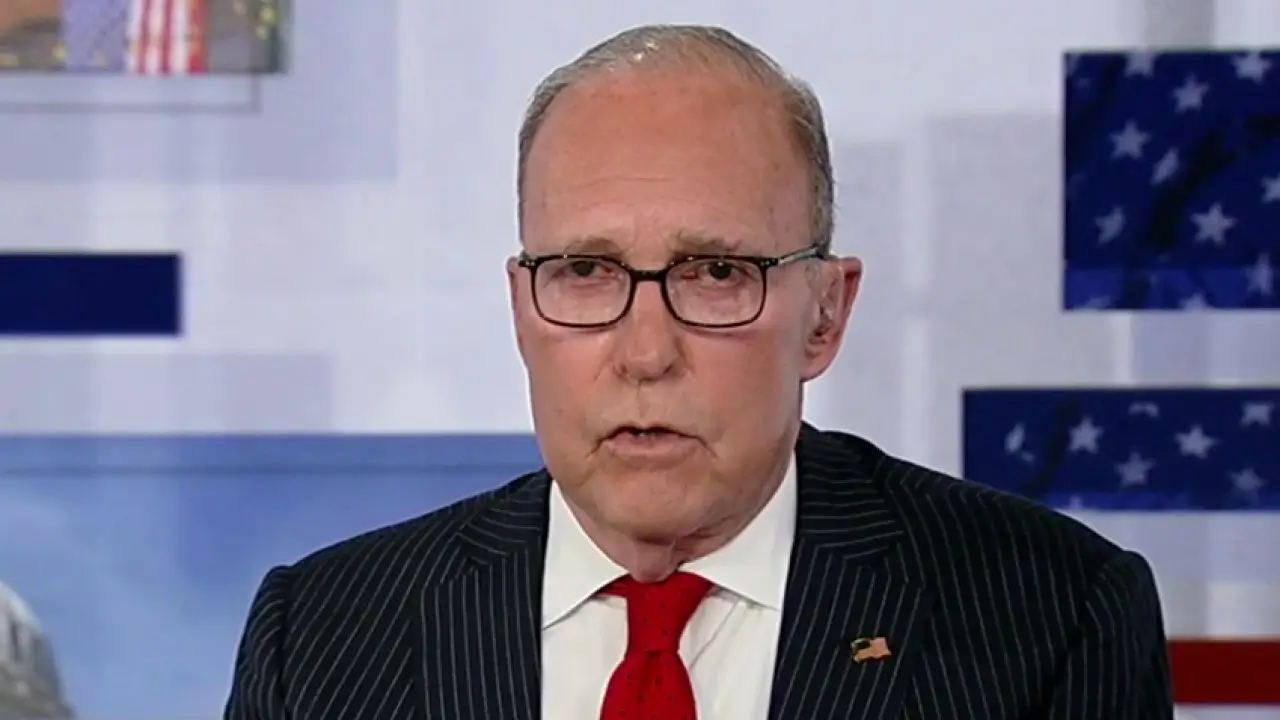

This proposal has received mixed reactions from both sides of the political spectrum, but one person who is in favor of this change is economic advisor Larry Kudlow.

Kudlow, who has been an outspoken supporter of President Trump’s economic policies, believes that this proposal will not only benefit employees but also boost the economy as a whole.

He argues that by allowing tipped employees to keep their tips, it will give them more incentive to work harder and provide better service. This, in turn, will lead to higher customer satisfaction and increased revenue for businesses.

The current tax rule requires tipped employees to report their earnings for the day to their employer, who then calculates and withholds taxes on those tips.

However, critics argue that this system is flawed as it allows employers to potentially pocket some of the tips or distribute them unevenly among employees. With Trump’s proposed change, tipped workers would be able to keep all of their tips and report them directly on their tax returns.

According to Kudlow, this proposal would not only give tipped employees more control over their earnings but also provide them with a sense of ownership and pride in their work. He believes that this will ultimately lead to an increase in job satisfaction and overall productivity.

But what about the impact on businesses? Kudlow assures that this change will not hurt business owners either. In fact, he argues that it will benefit them in the long run by reducing turnover rates and increasing employee retention. This is because employees will feel more valued and motivated to stay with their current employer.

Critics of this proposal have raised concerns about potential tax revenue losses for the government. However, Kudlow argues that this change will actually result in more tax revenue for the government as tipped employees are likely to report their tips honestly and accurately on their tax returns.

For more such trending local news post, bookmark our website TheWhistlerNews.